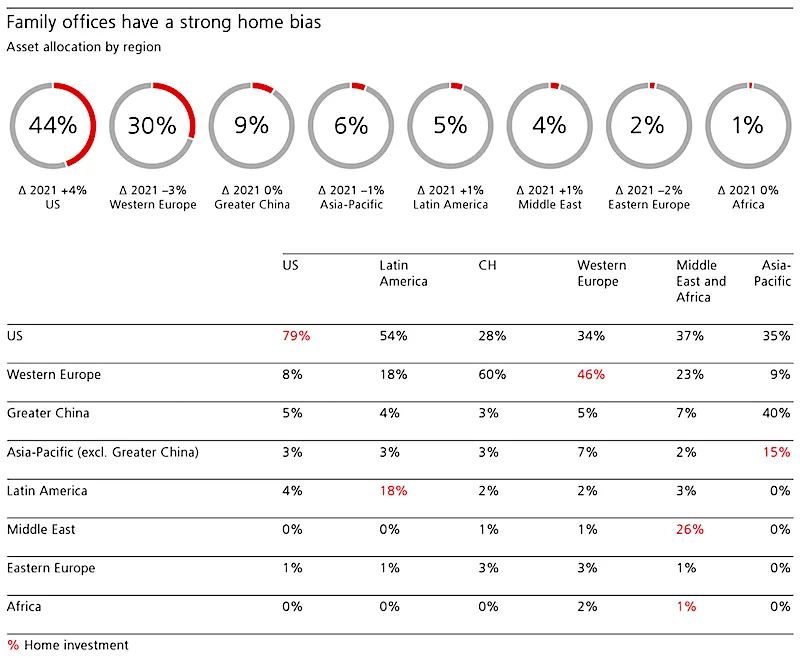

In family offices from the Middle East and Africa, the US accounts for 37% of assets, while the Middle East accounts for 26%.

Over the coming ten years, ultra-high net worth family offices’ investments in the Middle East will rise by at least 50%, according to statement given by a top official at Swiss global wealth management UBS to Arabian Gulf Business Insight (AGBI).

Family offices, or privately held businesses that manage a family’s investments and fortune aim to efficiently increase and transmit money over generations.

The most recent UBS Global Family Office Report 2022 examined 221 family offices worldwide, who jointly control $493 billion in wealth and average $2.2 billion in assets under management.

According to Josef Stadler, executive vice chairman of UBS Worldwide Wealth Management, who oversees some of the bank’s wealthiest clients, the Middle East only makes up 4% of family offices’ global asset allocations due to a lack of opportunity.

Because the domestic market lacks liquidity, there are few options to invest locally and nationally, according to Stadler.

“The amount of money chasing domestic asset opportunities exceeds the supply. So if you’re a big investor you naturally have to find alternative places to invest your money.”

Stadler thinks the Middle Eastern demand and supply dynamic is changing as a result of Saudi Arabia unveiling a roll call of mega projects as part of its Vision 2030 to diversify its economy, Qatar investing billions in the World Cup, and the UAE continuing to make it easier for foreign investors to enter the market.

He stated, “I think that four percent [of global allocation] will go up and it’ll take about ten years to get there”.

With 44% of all global asset allocations for family offices, the US is still the largest market, followed by western Europe at 30%.

In family offices from the Middle East and Africa, the US accounts for 37% of assets, while the Middle East accounts for 26%.

“China is growing: There are as many unicorns in China as there are in the US. That trend is unstoppable, and many Middle Eastern investors have invested in China and continue to do so,” Stadler said.

According to the UBS analysis, China presently makes up 7% of asset allocations in the Middle East and Africa, but Stadler thinks there are significant prospects, particularly in the technology sector.

The Swiss bank is increasing its operations in the Middle East as a result of the anticipated increase in commercial prospects.

“Our presence in Qatar was overdue, we think the region has massive importance,” said Stadler.

It was reported to have opened an office in Doha in February of last year to handle asset and wealth management services, and in October Swiss bank announced an expansion of its operation in Dubai to include a wealth desk to serve Kuwait and Oman.