Half of all hotel rooms in Doha remained empty during the month of July, although occupancy was up slightly compared to the same month last year, according to a recent review of hotels in major cities in the region.

While showing improvement, Qatar’s hotels fared relatively poorly when compared to hotels in neighboring Saudi Arabia and the UAE.

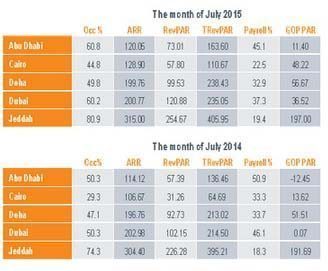

The latest edition of the monthly HotStats MENA market review shows that average room occupancy for hotels in Qatar during July stood at 49.8 percent, while hotels in Abu Dhabi and Dubai were 60 percent full during the same period and more than three-quarters (80.9 percent) of hotels in the Saudi city of Jeddah had paying guests.

Only Cairo hotels fared worse than Doha in cities studied for the review, with 44.8 percent of their rooms occupied over the same period.

Ramadan, which was in June and July this year, is generally not a popular time for Gulf residents to travel, and during the Eid Al-Fitr holiday in mid-July, many this year took the opportunity to escape the heat and humidity of the region.

And while the Emirates cities are popular summer holiday destinations for European tourists, Qatar’s visitor numbers largely comprise those from Saudi Arabia and other Gulf countries.

Although the Doha hotels lagged behind many of their regional neighbors in attracting guests, the average occupancy rate for hotels in Qatar’s capital was still up 2.7 percentage points compared to July last year.

A sluggish summer for Qatar hotels was offset by a busier first half of the year, helping to push the overall average occupancy rate for the seven months to July to 71.4 percent, showing a very slight increase on the same period last year, when rooms were 70.6 percent full, according to HotStats’ figures.

Attracting visitors

Qatar has ambitious plans to significantly develop its hotel and tourism sector, with the aim of attracting 7 million visitors to the state by 2030.

Half-yearly statistics published by Qatar Tourism Authority (QTA) in July showed that visitor numbers to the state were up by more than 100,000 in the first six months, putting it on track to meet its target of of 3 million visitors by the end of this year.

In a bid to cater to – and help create – increasing demand for tourists, dozens of hotels and apart-hotels are being built.

Qatar authorities have previously said they wanted to focus on attracting business travelers and those seeking high-end luxury retreats rather than low- and mid-income leisure tourists, for whom Dubai is a popular holiday destination.

Already this year, 11 new hotels opened, creating an extra 1,400 rooms, QTA said, adding that an additional 13 properties were scheduled to open during the latter half of this year, bringing a further 2,500 rooms on line.

Delayed hotel openings

However, it is not uncommon for hotels in Qatar to have to delay their openings, often several times. This can be due to a number of factors, including long lead-times for Civil Defense sign-off on the buildings and other paperwork issues.

Qatar’s first Westin Hotel, near the junction of Salwa Road and C-Ring Road, was supposed to open on September 1, however this has now been pushed back to November 1, according to an update on the hotel’s website.

The delay is due to issues with “licenses”, a hotel representative told Doha News.

While the hotel is taking room bookings from November 1 online, reservations for its restaurant are not yet available, the representative added.

The five-star hotel in Bin Mahmoud will have 365 rooms and suites, a spa, indoor and outdoor swimming pools, a kids’ club, banqueting space, three restaurants, a pool cafe, a lounge/cafe and a bar when it does finally open its doors.

The Shangri-La Doha next to City Center mall is another hotel which has struggled with its original timelines.

In 2012, when Shangri-La Hotels and Resorts announced it had signed a deal with Faisal Bin Qassim Al-Thani & Sons Holding Company to manage the hotel, opening was scheduled for early 2013, Hotelier Middle East reported.

However, hampered by legal and other issues, progress was significantly delayed. While a hotel spokesperson could not confirm an official opening date to Doha News, it is expected to welcome its first customers “soon”.

Meanwhile the Mondrian Hotel near Zig-Zag towers and Lagoona Mall has also had to push back its planned opening several times since it was first announced.

The Morgans Group, 31-story hotel was originally set to open in 2013, then the launch was rescheduled for 2014. In May last year, management said it would open this year.

No-one from the hotel was available to comment on its latest planned opening date.

Cheaper rooms

A Qatar hotelier has told Doha News that while he was upbeat that Doha would continue to grow as a destination for international and regional travelers, operators here will have to make their room rates more attractive.

Wissam Suleiman, General Manager of Marsa Malaz Kempinski Hotel on the Pearl-Qatar, said that more big-name hotels arriving on the scene would help to raise Qatar’s profile globally.

“I am optimistic. Five major hotels are coming soon to the city. We will have more marketing, this can show everyone that Qatar is a good place – it’s clean, there are great restaurants, it is a safe country. The competition will be beneficial,” he said.

However, as Qatar’s tourism market expands, he said that existing hotels would need to offer incentives to continue to attract customers to their establishments over their competitors.

“We all have some challenges over room rates. Qatar hotels are expensive, especially compared to those in other cities around us, although we have good quality.

Everyone will be looking for business, and I think everybody will be going to reduce their rates. In fact, this is starting to happen already. We have to have a good rate, to give the right opportunities for people to come here,” Suleiman added, saying his hotel planned to offer discounted rates for the upcoming Eid al-Adha holiday.

Thoughts?