South Korea’s President Yoon Suk Yeol is currently on a scheduled visit to the region, where he is due to stop off in Qatar.

The Korea Chamber of Commerce and Industry (KCCI) has suggested potential realms of cooperation in future energy, electric vehicles, and defence for Korea to tap into with a range of countries in the Middle East.

The report comes as South Korea’s President Yoon Suk Yeol embarks on a scheduled visit to Qatar and Saudi Arabia to discuss the developments in Gaza and joint economic cooperation, Seoul’s Yonhap news agency reported on Thursday.

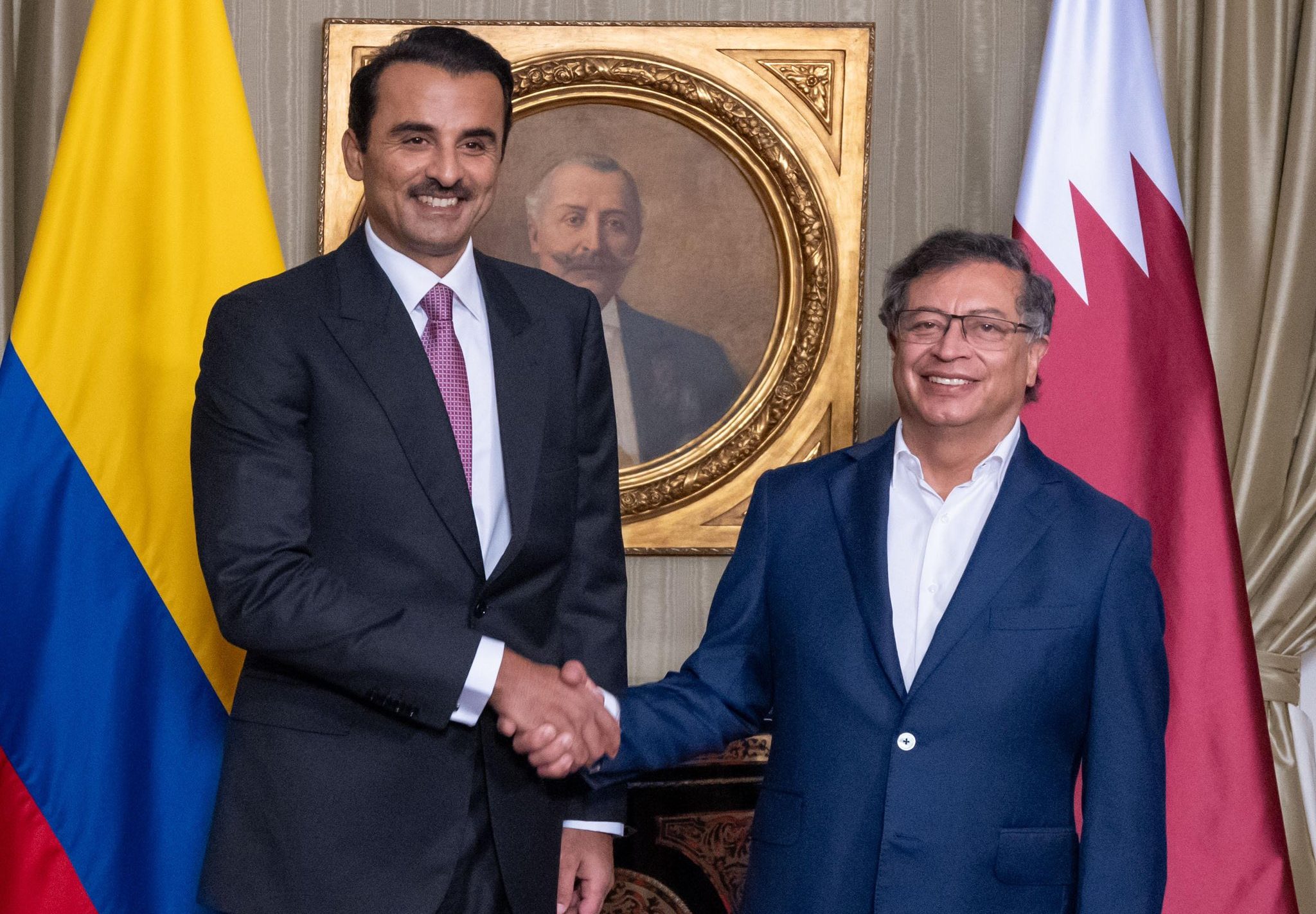

President Yoon is expected to visit Qatar between 24-25 October, where he will meet Qatar’s Amir Sheikh Tamim bin Hamad Al Thani. On Sunday, Yoon landed in Saudi Arabia for his first state visit as president.

“As Saudi Arabia and Qatar are two of our main trading partners in the Middle East, and key players in regional politics and the regional economy, friendly cooperation with these nations is essential to our economy and national security,” Principal Deputy National Security Advisor Kim Tae-hyo told a press briefing, as quoted by Yonhap last week.

The Korean official noted that the trip will “reinforce” Seoul’s relations with both Gulf states while exploring “new areas of cooperation.”

The KCCI’s report highlighted the economic importance of Qatar, Saudi Arabia, and the UAE, all of which topped the list of Korea’s most substantial trade partners.

The statistics reveal that trade between Korea and these countries saw a remarkable 61.6% surge last year, compared to the pre-Covid-19 year of 2019. This significant growth surpasses Korea’s global trade expansion of 35.3% over the same period.

Fuel

In 2022, Qatar played a major role economically for Korea, shipping out big quantities of natural gas that stood at $8.5 billion, crude oil at $4.89 billion, and naphtha at $2.44 billion to Korea.

The multibillion North Field Expansion Project comes under Qatar’s LNG endeavours and is split into two parts; the North Field East (NFE) and the North Field South (NFS).

NFE is set to ramp up Qatar’s LNG production from 77 to 110 mtpa (million tonnes per annum) by 2025, as the NFS will increase the production capacity from 110 to 126 mtpa by 2026.

Overall, the project is set to boost Qatar’s LNG production by more than 63% while adding 48 mtpa to the global production.

The project comprises six giant production lanes with a production capacity of eight million tonnes of LNG.

Qatar already holds long-term fixed contracts with several Asian customers— Japan, China, India and South Korea—who make up the majority of its exports, rendering the country’s capacity to divert only 10%-to-15% of its existing LNG production to Europe until its new projects are operational.

Qatar’s expansion of LNG production also falls in line with global efforts in cutting emissions, with the Gulf state promoting the gas as a green transitional fuel.

The use of LNG also aligns with the Paris agreement, which aims to limit global warming through the reduction of emissions.

Unlike compressed gas, LNG requires less storage space and reduces greenhouse emissions by 30-40%. The gas also remains the cleanest and safest to transport due to its ability to evaporate in the event that it is accidentally released in the process.

Meanwhile, Korea contributed by mainly exporting steel pipes which were approximately valued at $110 million and $60 million worth of automobiles to Qatar.

Korea imported a staggering $37.67 billion worth of crude oil from Saudi Arabia, while exporting automobiles standing at $1.24 billion, ships at $370 million, and arms at $280 million to the kingdom.

Future energy

The KCCI’s report identified future energy as a fertile sector for collaboration. Qatar, Saudi Arabia, and the UAE, are all significantly advancing the future energy sector, emphasising solar power and hydrogen.

Qatar, in line with it National Vision 2030, looks to to replace 20% of its total electricity demand with renewable energy by 2030.

Saudi Arabia launched the National Renewable Energy Program (NREP), aiming to meet 50% of its power generation needs with renewable energy by 2030. Similarly, the UAE, through its UAE Energy Strategy 2050, targets a 44% share of renewable energy generation in its total electricity production by 2050.

“The Middle East is optimised for the expansion of large-scale solar power generation facilities and hydrogen production facilities due to excellent climatic conditions such as abundant sunlight and relatively low land costs,” said Cho Il-hyun of the Energy Economics Research Institute.

“Korean companies will be able to seize many opportunities to enter the region.”

Electric vehicle

The report noted electric vehicles (EVs) is another sector of interest that Korea is striving to expand into.

Currently, Qatar is actively pursuing the EV agenda and aims for a 10% EV penetration by 2030. The Gulf state has ranked among the top 10 global markets in electric vehicle readiness, sitting in ninth place on the latest report on the ‘Global Electric Mobility Readiness Index (GEMRIX) 2023’.

With a conditional oil-reliant economy, Qatar’s commitment to enhancing sustainable mobility has advanced in the last decade as it falls behind the United States in EV market readiness.

Meanwhile, Qatar’s Ministry of Transport also aims to have a fully electric public bus system by 2030. There are also plans to set up 600 to 1,000 electric vehicle charging stations by 2025 and 2030.

In June, QNA reported on the launch of the first electric vehicles brand, VIM, with an exclusive Qatari intellectual property.

Separately, Saudi Arabia has set an ambitious target of producing 500,000 EVs annually by 2030, with plans to convert over 30% of cars in the capital, Riyadh, to EVs.

The kingdom is investing significantly in establishing an EV supply chain.

The UAE has witnessed electric vehicle imports soaring by more than 13 times in three years, jumping from $100 million in 2019 to a staggering $1.39 billion in 2022.

Korean automotive technology, from electric vehicle parts to vehicle manufacturing, has tapped into the Middle Eastern economies. Hyundai KEFICO, an affiliate of Hyundai Motor Group, inked a parts supply contract worth 700 billion won with Saudi electric car brand CEER in July.

Defence

In the report, the KCCI raised the prospect of expanding collaboration in the defence sector, citing a Stockholm International Peace Research Institute’s data.

The data reveals that Saudi Arabia and Qatar have ranked second and third in the world’s top arms importers for the past five years, accounting for 9.6% and 6.4% of the world’s total arms imports, respectively.