Qatar is the wealthiest country in the world per capita, yet studies suggest that up to 75 percent of its citizens are in debt.

Qatar is the wealthiest country in the world per capita, yet studies suggest that up to 75 percent of its citizens are in debt.

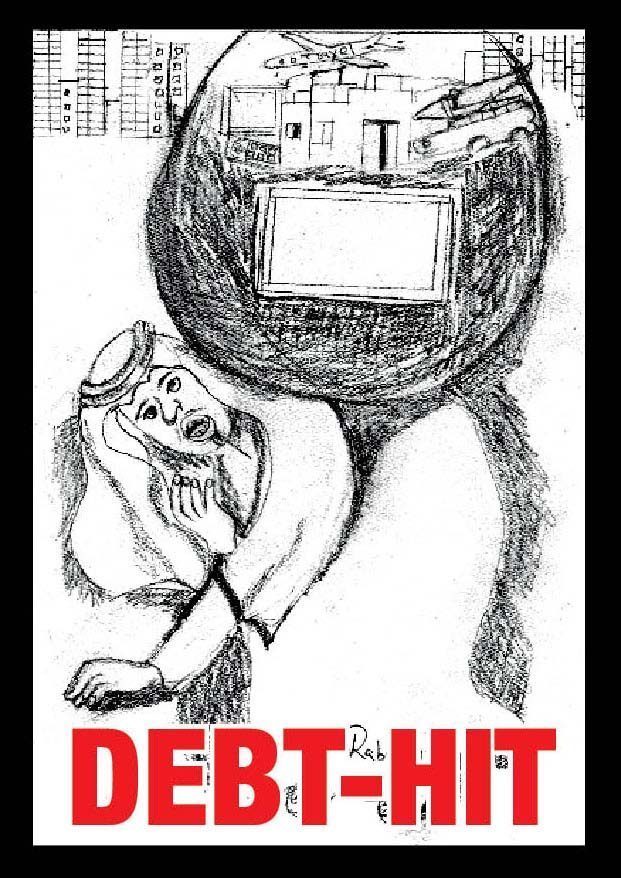

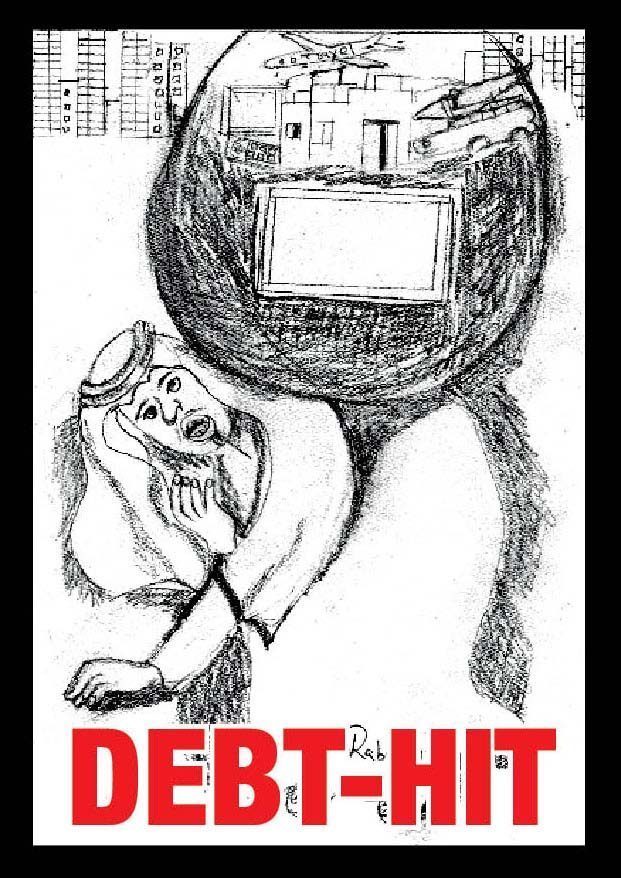

Why the baffling disparity? That was the question posed by the Peninsula in a seething Saturday commentary titled “Debt-Hit.”

In it, the emboldened English-language daily, whose website was down yesterday, shamed Qatar Central Bank for being “a mute spectator” by enabling the “reckless spending” that Qatari families seemingly can’t resist.

The article/analysis/opinion piece states:

The problem with the Qatari community is that people like to show off. The clamor for one-upmanship leads families to vie with one another with jealousies becoming so fierce that if someone buys a new car, his neighbor must follow suit with a laughable urgency.

Almost similar is the situation with regard to families making overseas trips for vacationing. A family going on a sojourn literally leaves in its trail a chain reaction in the neighborhood.

“We lack the culture of responsible spending and living within our means. Saving for a rainy day is alien to our culture,” admits a community source not wanting to be identified…

“The QCB is to blame for the rising indebtedness in our midst,” says Mohamed Sultan Al Ali, who owns an audit firm. “The QCB allowed the banks to dispense loans as much as 84 times a national’s salary. This was absurd,” Al Ali told this newspaper point blank.

The article concludes with suggestions on how to alleviate the debt crisis, including offering a one or two-year reprieve to those who can’t pay off their loans, freezing interest charges on people overloaded with debt, or – clearly the favorite option among nationals – having the government write off the loans and issue stricter lending policies in the future.

What do you guys think? How much of Qatar’s debt problem has to do with poor decision-making at home, and how much of it should be blamed on the government?