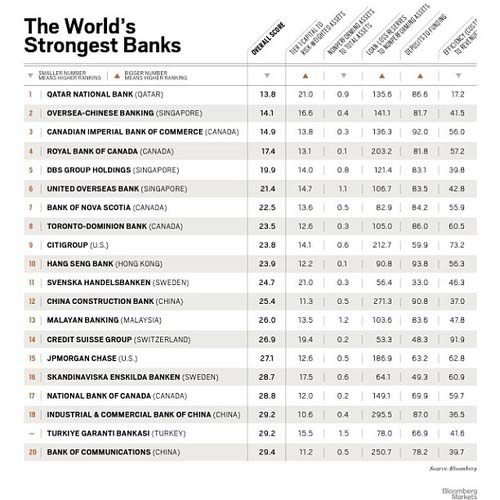

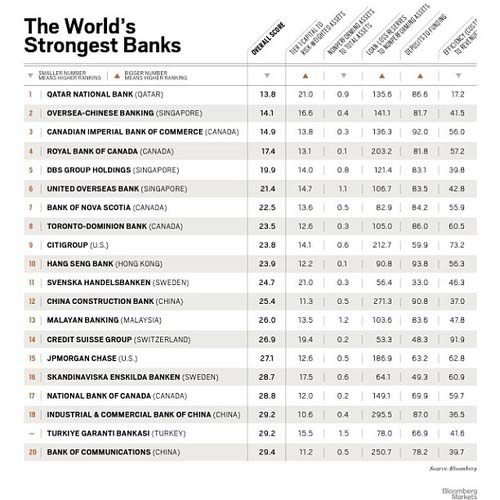

For the first time, a Qatar-based financial institution has topped Bloomberg’s annual report of world’s strongest banks.

Qatar National Bank SAQ, one of the largest lenders in the Middle East and one of the most profitable in fiscal year 2012, got the honor after surpassing $100 billion in assets this year.

It beat some 77 other banks with at least that much money, including Singapore’s Oversea-Chinese Banking Corp. (OCBC), which dropped to No. 2 after enjoying the top spot for the past two years.

State-backed strength

According to Bloomberg, QNB’s stellar fiscal performance has a great deal to do with the financial strength of Qatar itself, which is the world’s richest country per capita.

For example, the bank’s chairman, Yousef Kamal, is the country’s finance minister. And QNB is 50 percent owned by the Qatar Investment Authority. The report continues:

Bigger than all other publicly listed domestic lenders combined, QNB provided 66 percent of loans to the government and government-owned entities last year, while state agencies accounted for more than half of deposits, according to data provided by the bank.

“The bank is essentially an extension of the state,” says Akber Khan, director of asset management at Al Rayan Investment in Doha. “Any concerns about future capital adequacy or balance sheet strength are entirely redundant.”

But QNB’s CEO, Ali Shareef Al Emadi, argued that his bank’s success isn’t completely due to government ties.

“We are very close to the government and government agencies, but we get deals on a very much commercial basis,” he says. “We lose deals; we get deals.”

Al Emadi added that instability in the region due to the Arab Spring revolutions and Dubai’s fiscal woes all ended up benefiting Qatar.

“We always see good liquidity coming to us when things get bad in the market. That’s a very strong signal from customers and investors that they view the bank as a safe haven.”

Thoughts?

Credit: Image courtesy of QNB on Instagram