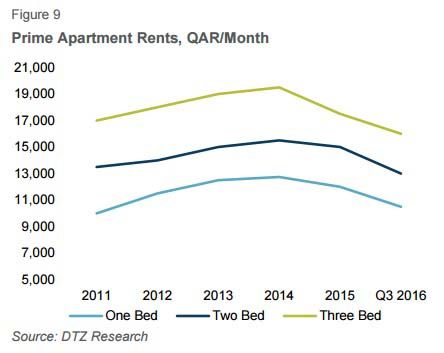

Apartment rents in popular central Doha districts such as Al Sadd, Bin Mahmoud and Al Mirqab are finally starting to come down, according to a new real estate report.

Some properties are now up to 10 percent cheaper than last year, saving tenants between QR500 and QR1,000 a month.

The change comes following an exodus of people from Qatar earlier this year, DTZ Qatar said in its Property Times report for Q3 of this year.

Additionally, in recent months, more “affordable” apartments have convinced residents to relocate to areas like Ain Khalid and Muaither.

The report added:

“The increasing provisions of ‘affordable housing’ on the outskirts of Doha is putting pressure on landlords in more central locations to provide more flexible lease terms for vacant units.

Many (are) offering apartments and villas at rents that are between 5 percent and 10 percent below what would have been achieved in 2015.”

Fewer people, more supply

The DTZ quarterly “snapshot” highlights trends in the residential, commercial, retail and hospitality sectors in Qatar.

Overall, the months of July, August and September this year showed a similar picture to the previous quarter, particularly at the luxury end of the residential rental market.

The launch of more apartment blocks, especially on The Pearl-Qatar, plus a swathe of white-collar workers leaving Qatar means that the price of renting a villa or apartment in West Bay, The Pearl and Al Waab remains around 10 percent cheaper than last year.

However, there has been little movement in rents between the two quarters, Johnny Archer, associate director of research and consulting at DTZ Qatar, told Doha News.

The average five-bedroom villa in Al Waab currently rents for around QR18,000 or QR19,000, while a three-bedroom house is still about QR14,000.

Meanwhile, a three-bedroom apartment on the Pearl will rent for around QR16,500. And tenants can get a one-bedroom property on the island for approximately QR10,000, DTZ figures show.

Nevertheless, the market could pick up in 2017, Archer said.

This would come on the heels of recent announcements by Sidra and Hamad Medical Corp. (HMC) to increase staff numbers in the coming year, plus Qatar’s energy ministry’s statement this week that the worst of the oil crisis is over.

“We are hopeful for 2017. There seems to be more stability in the oil and gas sector. It seems that the redundancy programs are behind us,” he added.

However, an uptick in demand is unlikely to translate into rent increases again in the coming years, the report states.

This is because more accommodation is likely to be added to the rental market in the run-up to 2018.

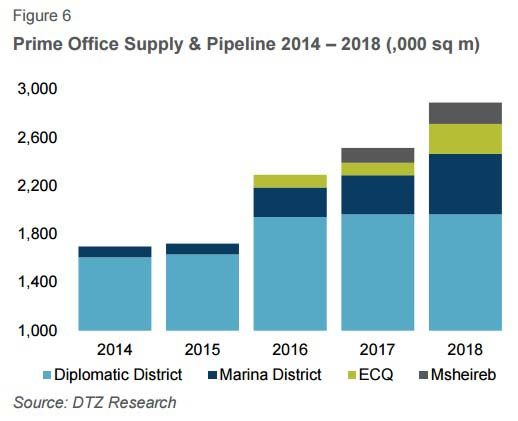

Office construction

The report also said that office rents over the summer continued to be down around 10 percent from last year.

This is due to ongoing “subdued” demand for space from hydrocarbon and public organizations, DTZ said.

These two sectors occupy up to three-quarters of all commercial space in prime locations such as Dafna/West Bay, but government cut-backs have caused a “significant fall” in demand for office space.

As such, around 17 percent (300,000 square meters) our of the area’s total 1.63 million square meters of office space in the area was up for lease in the last quarter.

When it opens, the QP district is expected to add an extra 200,000 square meters to that. However, when it will come onto the market is not yet know, the report noted.

Oversupply has translated into cheaper rents for companies in the business district:

“Quoted rents have, on average, reduced by between 10% and 15% for most buildings in West Bay, as landlords compete for tenants,” the report states.

That said, commercial building projects are continuing apace around Qatar. The nation is expected to see 2 million more square meters of space in the coming decade.

This will be concentrated in Msheireb, Lusail Marina, Energy City in Lusail and West Bay.

The report concluded:

“In DTZ’s opinion this is likely to increase vacancy rates, and potentially lower rents, unless there is significant uptake in demand from both the public and private sectors in the next five years.”

Thoughts?