Qatar will spend some £5 billion on the UK’s economy over the next three to five years, its prime minister has announced.

The pledge to further invest in the UK’s infrastructure, real estate and technology comes at a critical time for the country, which is preparing to leave the European Union.

PM Sheikh Abdullah bin Nasser Al Thani made the announcement during a business and investment forum in London yesterday.

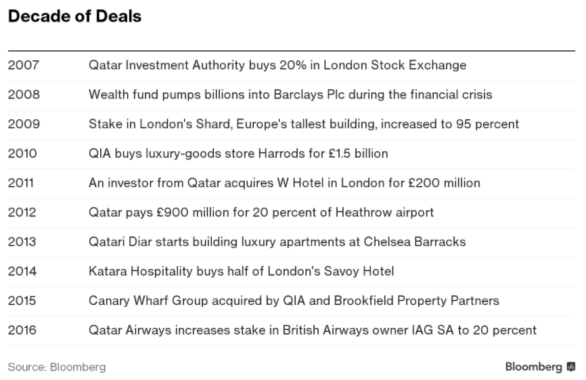

The two countries already have a strong relationship, with Bloomberg reporting that Qatar has previously injected some £35 billion in the nation.

Much of this comes in the form of UK real estate, as Qatar owns the Shard, the Olympic Village and Canary Wharf, among other properties.

Qatari students and tourists also frequently visit the country. And the Gulf state currently supplies the UK with 90 percent of its imported fuel.

Cushioning Brexit

According to Bloomberg, all of this helps explain why Qatar has a “big stake” in keeping the UK’s economy strong once it exits the EU.

Over the next few years, the UK will be taking the investment through the Qatar’s sovereign wealth fund, which remains very interested in the nation:

During this week’s forum, the CEO of the Qatar Investment Authority (QIA) Sheikh Abdullah bin Mohamed bin Saud al-Thani said:

“There is a pressure from my board to diversify in terms of geography and asset class, but we are still looking, even after Brexit, for opportunities (in Britain).”

Beyond Europe

Qatar is also hoping to attract investment to its own country, which is struggling with falling revenue from lower oil prices.

It has been doing so in part by expanding its relationships in Asia and the US.

According to Reuters, the QIA announced plans this week to open an office in San Francisco.

The moves comes after Qatar committed to spending $35 billion in the US by 2020.

Thoughts?