The report states that Qatar’s food inflation has been at a comparatively low figure of -0.01% as the MENA region struggles with high food prices.

The World Bank, IMF and Trading Economics have published their annual food price inflation tracker for multiple countries from February-May 2023.

Data collected from Qatar Statistics Authority informed the findings and decisions of the report.

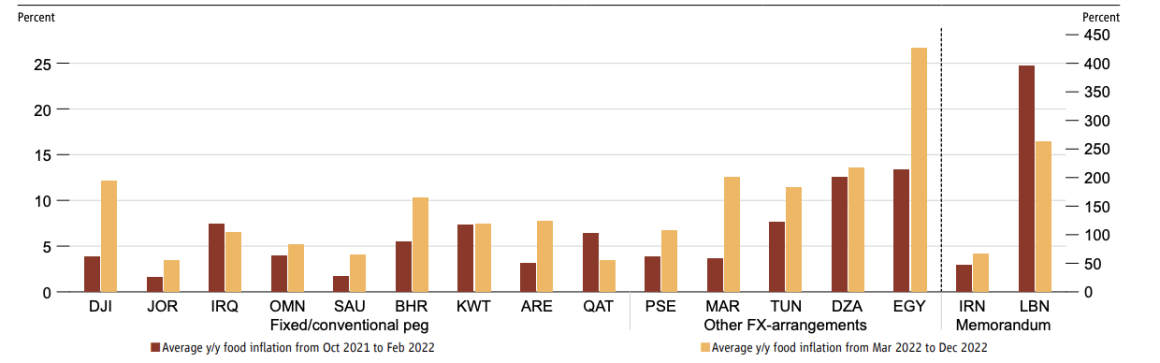

Late last year, Qatar recorded a price spike partly due to global food shortages caused by the Ukraine war and partly in the lead-up to the world cup. Yet, yearly food inflation has stabilised and recovered since then.

Month-to-month food inflation numbers stood at 4.8% in July last year, 6.4% (August 2022), 4.6% (September 2022), 1.3% (October 2022), 0.3% (November 2022), 1.5% (December 2022), -0.6% (January this year), -1.9% (February), 0.7% (March), 1.4% (April) and -1.5% (May).

The World Bank calculated this “real food inflation” data by finding the difference between food and overall inflation.

In the meantime, according to IMF, Qatar’s general inflation of consumer goods this year is expected to be 3% compared to the Middle East’s 12.6%. Unlike most countries in the GCC, inflation isn’t dictated much by food inflation.

Region in crisis

Qatar is an anomaly in a region plagued with double-digit food price inflation.

Reuters reported earlier this year that growth has slowed down in the MENA region from an overall 5.8% to 3%, partly exacerbated by food shortages. This comes as average year-on-year inflation for 2022 stood at 19.4%, according to the World Bank and becomes even worse when considering food inflation, mainly when the average food inflation was 29%.

One way this increased inflation manifested itself through the report is with the possibility of an increased risk of stunting by 17-24%, which translates to 200,000 to 285,000 infants at risk of stunting in developing MENA economies.

“Bold policies are needed in a region where young people make up more than half of the population,” World Bank MENA Vice President Ferid Belhaj told Reuters.

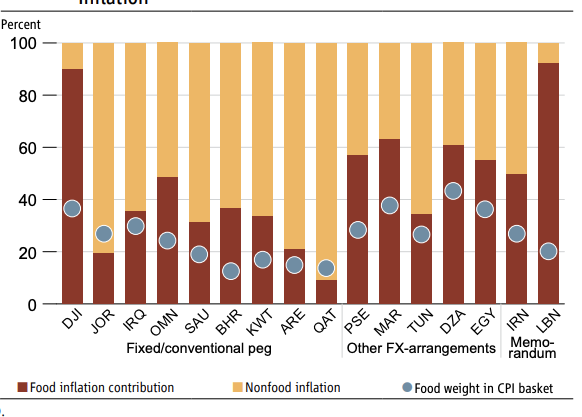

Indeed, the region has a wide variety of economies, from oil-exporting titans to conflict-affected nations.

Inflation and demand for exported goods affect these countries differently. GCC nations, in particular, are expected to continue to grow despite inflation, albeit at a decelerated rate from 7.3% in 2022 to 3.2% in 2023, mainly due to decreased demand in oil prices compared to the highs reached last year.

Mitigation policies

While Qatar hasn’t been involved in creating new product markets and social transfer policies since February 2022, other countries in the region have been particularly active. Countries outside of the GCC in particular have increased food and fuel subsidies, created new price controls and trade regulations, regulated prices, reduced subsidies, added cash transfers and indirect tax exemptions.

However, even with these policies, food inflation has increased across the region. This does not necessarily imply that the procedures to contain food product prices were ineffective; food inflation might have been higher without them, yet the reports from the World Bank argue that these interventions may not be the most efficient use of scarce fiscal resources, especially for oil-importing countries.

“Their distortive nature can create imbalances in product markets, which can have negative long-run implications for macroeconomic outcomes,” the report argues.

The difficulty in rolling back these policies may be a sign that, even if intended as temporary measures, they are harder to unwind than anticipated.