Qatar is “well-positioned” to manage the impact that lower oil prices have had on its revenue, the International Monetary Fund (IMF) has said.

The country has taken the necessary first steps to handle new deficits by cutting expenditures and diversifying its economy, the IMF added in a recent assessment.

Though there is a risk of rising inflation and continued lower oil prices, the fund has expressed confidence in Qatar’s economic future.

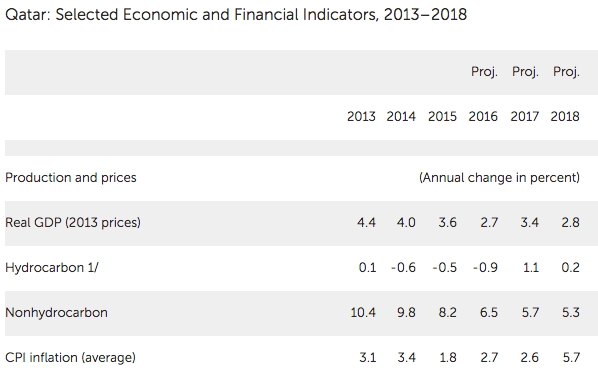

That said, it still forecast the cost of living (CPI) in Qatar to rise from 2.6 percent currently to 5.7 percent by 2018.

This is likely due to the upcoming rollout of two new taxes in Qatar, a value-added one and a selective tax on fast food, luxury goods and other items.

Recommendations

One indicator of Qatar’s economic health has been its GDP. It rose from 2.7 percent in 2016 to an expected 3.4 percent this year, thanks to investment in infrastructure projects.

To keep things running smoothly, the IMF offered several suggestions to authorities.

For example, it urged Qatar to continue its plans to cut subsidies, lower spending and roll out its new taxes.

The IMF also encouraged Qatar to do more to ensure it is efficiently managing its investments. And it suggested further transparency is needed when explaining the country’s fiscal position.

Other ideas included:

- Enhancing anti-money laundering efforts to combat the financing of terrorism;

- Strengthening banks by developing a more “active liquidity forecasting framework”; and

- Improving Qatar’s business environment through labor market and education reform.

Thoughts?