Qatar will likely collect far less money in the coming decade from the sale of natural gas, the main funding source of its rapid development in recent years, according to a recent forecast.

The prediction was made in a report published by the Columbia Center on Global Energy Policy (CGEP), and comes as Qatar continues to spend heavily on new roads, rail lines as well as power and desalination plants to meet the needs of its growing population and to prepare for the 2022 World Cup.

These public expenditures have largely been paid for with proceeds from natural resources sales, as Qatar has grown to be the world’s largest liquefied natural gas (LNG) supplier.

The CGEP says Qatar’s annual revenues from LNG sales totaled US$56.5 billion in 2013. However, it expects that new LNG development projects around the world, particularly in Australia and North America, will cause Qatar’s pricing power to decline and its revenues to take a hit.

Under one scenario put forward by the CGEP, Qatar’s LNG revenues could plunge 34 percent to $37 billion in 2026.

Preparations

Qatar has attempted to diversify its economy in recent years by attracting more tourists and positioning the country as a global aviation hub.

Additionally, the current construction boom is coming close to overshadowing the economic impact of the natural resources sector.

However, most of these projects are one-time initiatives that show no signs of being a sustainable, long-term source of wealth, a government report published in December concluded.

The country’s large financial reserves provide it with a significant buffer and the ability to continue spending despite lower revenues, although any income from natural resources would likely put more pressure on politicians to curb spending.

But the CGEP notes that Qatar’s massive natural gas reserves – estimated to be the third-largest in the world – give it the option to force some its competitors out of the market if it chooses to lift a long-standing moratorium on further development.

Pricing power

Qatar has historically used its strategic position between European and Asian markets to help it maximize its natural gas revenues.

CGEP said that Qatar has shifted sales to Europe during periods of low spot prices in Asia, and then toward Asia when demand pushed prices higher.

However, new supplies are threatening this model:

“The advancement of US shale opens the prospect that the United States and possibly other suppliers could compete with Qatar, undermining its ability to exercise pricing power. This could have profound implications for gas prices, gas pricing dynamics, and Qatar’s ability to influence prices. Rather than acting as a ‘discriminating monopolist,’ Qatar may become a price taker in Europe and Asia,” CGEP said.

Still, Qatar is likely to retain a major advantage over most of its competitors – many of whom are developing costly unconventional gas resources – and remain the lowest-cost supplies of LNG, CGEP says. This gives it additional options, the report’s authors say.

Moratorium

A ban on further development of Qatar’s North Field gas reserve has been in place since 2005. Government officials have given no indication when the moratorium may be lifted as they undertake technical studies to determine development strategies.

If Qatar were to lift the moratorium and announce plans to bring more gas to market, it could “intimidate competitors into deferring competing projects,” CGEP stated.

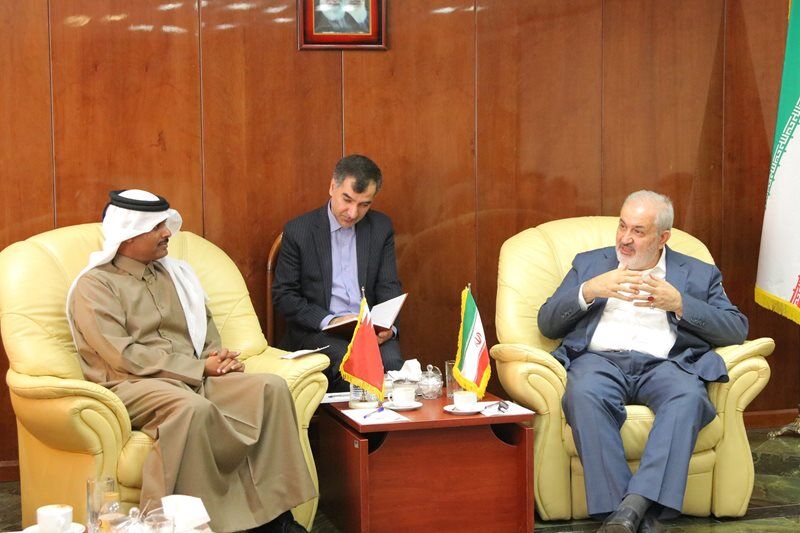

For his part, Qatar Energy Minister Mohammed bin Saleh Al-Sada said last year that the country’s energy strategy remains unchanged in the face of competition from US shale gas.

Speaking to the Telegraph, Al-Sada said the country has the flexibility and ability to respond to changes in the global gas market.

“Qatar’s role as an undisputed leader in the global energy market is set to remain for years to come.”

Thoughts?