The resolved rift between Lebanon and Israel was triggered in 2007 when Beirut and Nicosia signed an agreement to delimit their maritime border.

QatarEnergy is in talks with Lebanon to acquire a 30% stake in an offshore exploration block, the state-owned energy company’s CEO Saad Al-Kaabi told the press on Sunday.

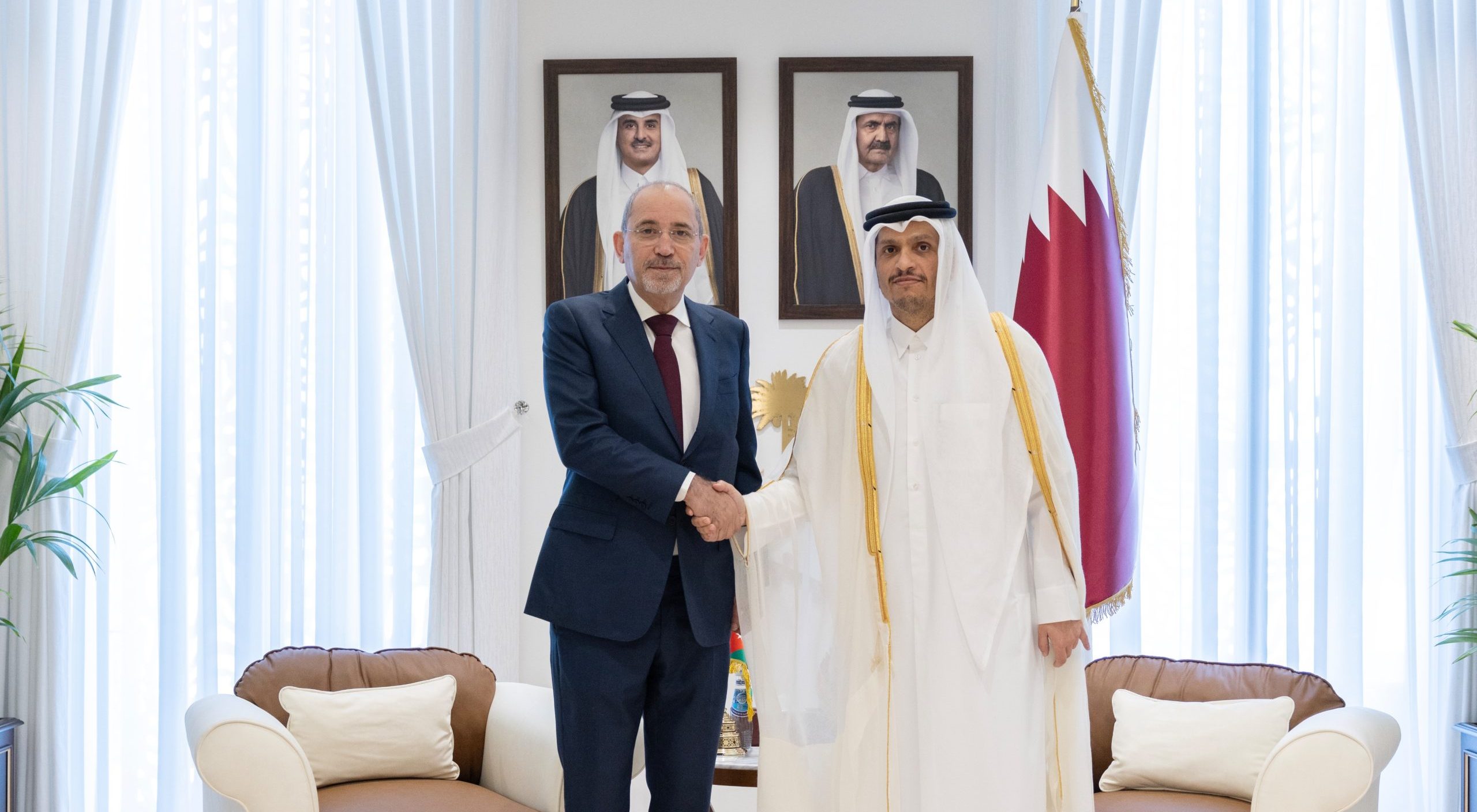

“We are in the process of discussing that with the government of Lebanon and the partners, Total and ENI for a participation of around 30% ownership of that exploration block,” said Al-Kaabi, who is also Qatar’s minister of state for energy affairs.

The Qatari energy official added that the company will be announcing the agreement “in due course” – once it is finalised and signed. Al-Kaabi said QatarEnergy is also in talks with TotalEnergies and Italy’s ENI.

Last week, sources told Reuters that the French company and the Lebanese government had reached a deal, under which the former would temporarily hold majority control of the block.

The deal would then pave the way for negotiations with Qatar for a stake in the gas project, joining the tripartite consortium.

Beirut’s cabinet revealed earlier this month that Qatar had expressed interest in joining companies in the exploration of Lebanon’s Qana field. The statement came shortly after a major breakthrough in the maritime borders dispute between Lebanon and Israel following US mediation.

Under the reported agreement between the Lebanese government and TotalEnergies, the latter can begin talks for a third company to join its consortium of three parties.

Previously, the license was granted to TotalEnergies, Italy’s Eni and Russia’s Novatek.

The sources further told Reuters that Lebanon is transferring the previous 20% stake owned by Novatek to one of TotalEnergies’ vehicles, known as Daja 216.

Qatar would reportedly receive Novatek’s previous stake, with QatarEnergy expected to join the consortium within the next three months. The sources said the Gulf state is seeking 30%, including a 5% share from TotalEnergies and Eni.

Lebanon is reportedly transferring another 40% stake to Daja 215, another vehicle owned by the French company.

The years-long dispute

The resolved rift between Lebanon and Israel was triggered in 2007 when Beirut and Nicosia signed an agreement to delimit their maritime border.

Then in 2010, Israel and Cyprus then signed an agreement over the same zones mentioned in the agreement signed by Lebanon and Cyprus.

Unlike Cyprus, Lebanon has no diplomatic ties with Israel and refuses to normalise with the Zionist state, which previously waged deadly wars on Beirut.

The issue then resurfaced in 2017 when Lebanon inked a gas exploration and production agreement with various companies, including France’s Total.

The French company had refused to begin operations on Block 9—situated in the disputed zone —until the maritime issue was resolved.

In 2011, then-US envoy mediator between Beirut and Tel Aviv Frederic Hof presented a compromise to former Lebanese Prime Minister Najib Mikati to give Lebanon 55% of the area and the remaining 45% to Israel.

During the same year, Lebanon issued Decree 6433 to the UN to claim Line 23, which does not fall on the Karish field. To date, Israel maintains that the field is in its economic zone.

Following studies by the UK Hydrographic Office and Lebanese Army, Lebanon found it can claim an additional 1,430 square km of the area, known as Line 29.

The deal over the border dispute is deemed to be crucial step in alleviating Lebanon’s suffering amid its multifaceted crisis that was made worse by the Covid-19 outbreak and 2020 Beirut blast.

The population has limited electricity access with long lines of cars stretched outside gas stations becoming a norm.

Lebanese President Michel Aoun approved the deal in Beirut on Thursday, who has since left office, and Israeli Prime Minister Yair Lapid later signed it in Jerusalem. According to Reuters, a ceremony is scheduled to take place at the level of representatives at the UN’s office in Naqoura.