(Note: The interview with Chinese ambassador Gao Youzhen was conducted in Arabic. The questions and answers were translated by Riham Shebl.)

China’s top diplomat in Doha has said he wants to increase arms sales from his country to Qatar and boost bilateral trade between the two nations beyond the US$10 billion recorded last year.

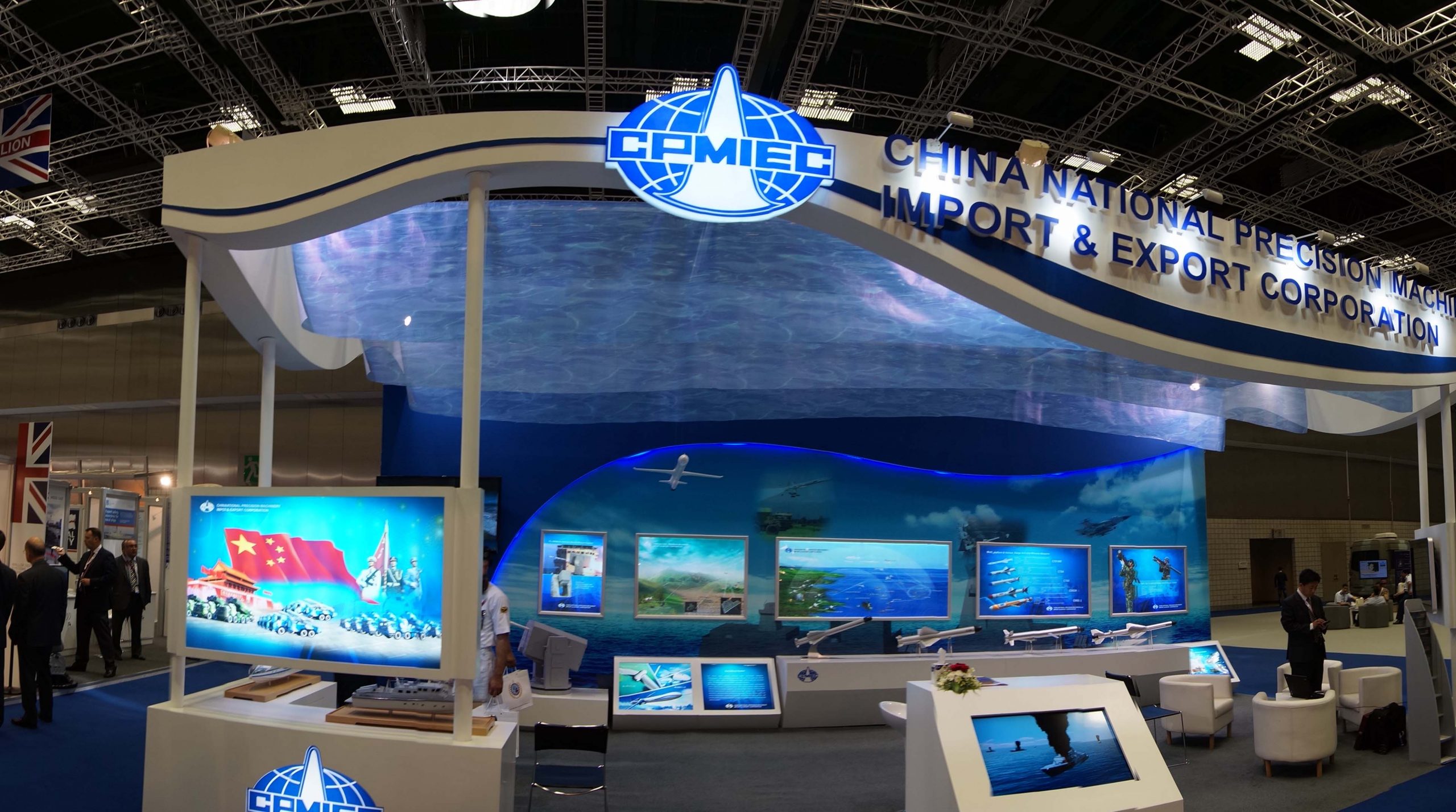

Ambassador Gao Youzhen spoke to Doha News last week as officials from missile manufacturer China Precision Machinery Import-Export Corp. (CPMIEC) visited Qatar to participate for the first time at the biennial Doha International Maritime Defence Exhibition (DIMDEX).

Qatar’s armed forces signed contracts for QR87 billion (US$23.89 billion) worth of military hardware during the show, including tanks, helicopters, warships and artillery.

The Gulf country didn’t buy any of CPMIEC’s missile weapon systems, which include armaments for air, coastal and ground attacks that vary in range from six kilometres to 280 kilometres, according to company vice-president Nan Dang.

However, he said he was unfazed and that his company was using the visit to build relationships with potential customers and gain a better understanding of the local market and its needs.

“These things takes time. And we are patient,” he said.

“The Middle East is a very important market for us (and) we pay special attention to the GCC,” Dang added.

Arms trade

China has quickly become the world’s fourth-largest weapons exporter, according to the Stockholm International Peace Research Institute. Its data shows the volume and value of Chinese arms sales more than tripled between 2008 and 2013.

In a New York Times interview last October, Xu Guangyu, a retired major general in the People’s Liberation Army and director of the China Arms Control and Disarmament Association, explained the Chinese advantage:

“In arms manufacturing, China is trying to increase the quality and reduce price,” he said. “We’re driven by competition.”

Chinese companies have another edge: they do not “make demands over other governments’ status and internal policies.” He added: “Our policy of noninterference applies here. Whoever is in the government, whoever has diplomatic status with us, we can talk about arms sales with them.”

CPMIEC’s Dang said he is also interested in selling to Qatar’s wealthy Gulf neighbors, which are also increasing military budgets.

“The Middle East is a very important market, (and) we pay special attention to the GCC.”

While Qatar may be one of many prospective customers for the growing Chinese arms exporting industry, there are nevertheless signs that the broader relationship between the two countries is deepening.

Sino-Qatari relations

Along with selling it more military equipment, Youzhen said he hoped China and Qatar could increase their military cooperation in other areas. High-ranking members of each country’s armed forces routinely visit their counterparts, and Chinese delegates regularly participate in defence-related training activities and conferences in Qatar, he said.

“There are very strong and good relations between the two countries in many (areas), but particularly in defence,” Youzhen said.

Trade between the two countries grew from $8.5 billion in 2012 to $10 billion last year, mostly on the strength of energy exports – namely natural gas – from Qatar as well as Chinese shipments of electronics and building materials to the Gulf.

The two countries are also working together to extract Qatar’s natural resources and meet China’s growing energy needs.

For example, Qatar Petroleum signed a deal in 2010 with PetroChina and Shell to explore and produce an 8,100-square-kilometer gas field near Ras Laffan. A year later, the three companies entered into an agreement to build a petrochemicals and refining complex in Zhejiang province in east China.

A large chunk of the money China sends to Qatar in exchange for gas finds its way back to the Middle Kingdom; the Gulf country’s sovereign wealth fund received special permission as a foreign entity in 2012 to invest in China’s capital markets.

“Qatar invests heavily in (Chinese) banks and the stock market,” Youzhen said.

He also spoke with Doha News about several other facets of the relationship between the two countries:

- Dragon Mart is unlikely to imminently open. Youzhen said internal fit-ups are still being constructed inside the plaza, which will feature roughly 300 merchants selling Chinese-made products, including building materials, furniture, electronics and textiles across some 20,000 square meters of space on Barwa Commercial Avenue. He said he didn’t know the exact opening date. Embassy officials told Doha News in January that the delay was due to Civil Defense licensing issues.

- There were approximately 6,000 Chinese citizens living in Qatar last year, roughly the same number as in 2012. Youzhen suggested most are in the country working on projects for Chinese companies such as SinoHydro, which said it received a $1.4 billion infrastructure project in Lusail City. Chinese companies are also involved in constructing Qatar’s new port.

- China would eventually like its national airlines to fly to Doha. Qatar Airways began flying to its seventh Chinese destination, Hangzhou. Despite the Gulf carrier’s service expansion, no Chinese airline currently flies to Doha. “This will probably change in the future,” Youzhen said, “But it is the business of airlines and their business decisions.”