Green bonds are fixed-income financial instruments that are used to finance initiatives that benefit the environment and/or the climate.

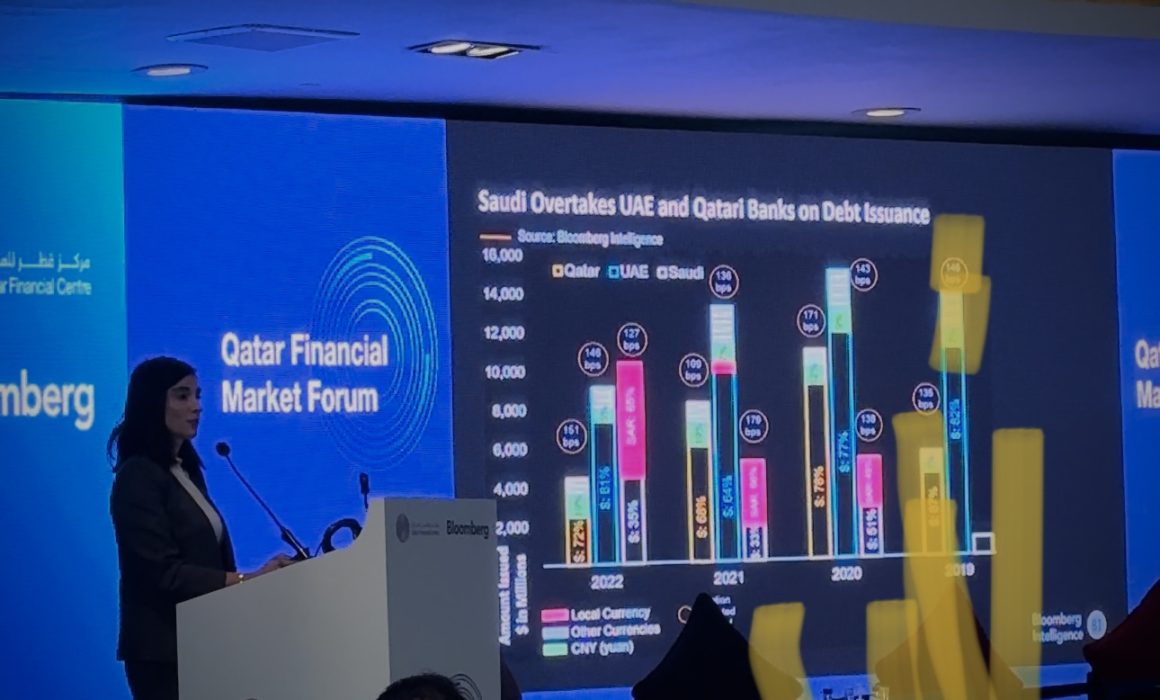

The total debt issuances in the GCC region have topped $105 billion since 2019, however, only 5% were green bonds, according to Bloomberg data presented at the Qatar Financial Market forum.

The data shows foreign money is eyeing more green investments, with 3 % of total GCC bonds issued in 2020, 2021, 2022 being green.

Buyers of such green bonds were institutions and international investors. In 2022 alone, the GCC region had eleven green bond issuances, six were from banks like Abu Dhabi Bank, Abu Dhabi Commercial Bank, and one from Saudi National Bank.

“However, in both 2021 and 2022 there were no green issuances in Qatar, that clearly shows that there’s room to improve,” said Lea El-Hage, Senior Associate at Bloomberg Intelligence.

An asset class known as a “green bond” is a fixed-income security that is intended solely to raise capital for environmental and climate change initiatives. These bonds typically have the same credit rating as their issuers’ other debt obligations because they are asset-linked and backed by the issuing entity’s balance sheet.

Effective frameworks and legislation need to be put in place in order to support both the issuer and the investor, and El-Hage believes that this is starting to take shape in the region. “For example, we have the QFC sustainable green bond framework which is very crucial in order to incite more green issuances.”

However, she thinks that more could be done to entice issuers to have more green bonds, by having a ‘greenium’.

“A Greenium is when you have two bonds that are issued with the same characteristics, so they have same payment terms, same coupons, same maturity, usually the green bond should trade at a lower yield, because the issuer is expected to be compensated because they’re investing in a green project, and the investor is willing to compromise some of his return because they’re investing in green bonds,” the expert added.

According to El-Hage, if all of the GCC’s USD and euro issuances were compared, no greenium would be found. “That could be because of a lack of liquidity, or a tightening in regulations in Europe thats actually not driving enough of this money into the region.”

If there are more regulation in place then there would be more demand from foreign investors and the issuers could actually benefit from lower costs, believes the Bloomberg expert.

Meanwhile, Qatar is currently working to create a capital market that is more diverse. The nation is poised to establish a specialised sustainable finance market, which is anticipated to reach a global value of over $22 trillion by 2031.

This is thanks to established regulations for the governance of current and new financial investments and ongoing efforts to adopt comprehensive approaches to capital market development.

Last March, Qatar’s Finance Minister Ali Al-Kuwari confirmed his country’s plans to issue green bonds to Bloomberg, noting that the timing depends on the market’s conditions.

The statement came after the news agency reported in January 2022 that the Gulf state held talks with international banks in a bid to raise billions of dollars through green bonds.