Former blockading countries have reportedly attempted to attack Qatar through multiple smear campaigns over the years.

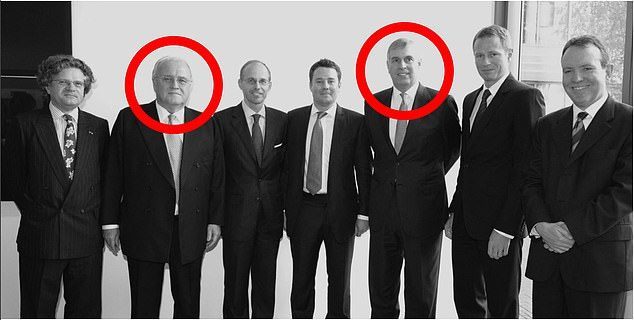

A prominent UK banker, close to royal Prince Andrew, has been associated with a Saudi-UAE smear campaign against Qatar, British media reported on Monday.

Tory donor David Rowland has been accused by Qatar’s legal representatives of being involved in a plot by “some of the UK’s closest international allies to undermine the Gulf state by manipulating financial markets.”

Rowland owns Banque Havilland, a private bank headquartered in Luxembourg that has faced a lawsuit by Qatar, accused of orchestrating an attack that cost the Gulf state $40 billion to support its currency.

The campaign dates back to 2017, when Saudi Arabia along with UAE, Bahrain and Egypt imposed an illegal land, air, and sea blockade on Qatar over its alleged support of terrorist groups. Doha has vehemently and consistently denied those allegations.

Qatar accuses UK financier of ‘brazenly’ hiding evidence in Banque Havilland case

Qatar has accused Rowland, 76, of covering up his alleged role in an attack plan carried out alongside figures in Saudi Arabia and the UAE, and the plaintiff’s lawyers have indicted Rowland of attempting to hide evidence and attempting to avoid a probe.

The bank has denied involvement and the judge said Rowland will not voluntarily give access to email accounts.

According to the report, Rowland is “not a defendant in the proceedings, so has not had the opportunity to respond in court.” The judge has not made a ruling on the accusations.

The financier allegedly pledged over £6 million to the British Conservative Party and has closely cooperated with Prince Andrew. The British royal even reportedly unveiled a statue of Rowland at his property in Guernsey.

Read also: Qatar slams ‘baseless’ The Times article on terror funding

Meanwhile, a High Court judge has raised concerns about the performance of Rowland’s bank after no relevant documents or information were provided.

The case has also raised questions on the reasons behind why Rowland’s email account at Banque Havilland was deactivated just before the 2017 GCC crisis was sparked.

“In a ruling, Judge David Edwards QC called for more information about why Mr Rowland’s email account at Banque Havilland was deactivated as the scandal was about to emerge in 2017,” the Daily Mail reported.

A recorded phone conversation that was “withheld” from the court was also brought to the judge’s attention. The phone call is said to have been held between Rowland and his son Edmund, a director at the bank, saying: ‘I accept, of course, that mistakes happen, but it was plainly required to be disclosed.’

Doha is now claiming damages of several billion dollars from the bank, which the businessman controls through a trust. The Gulf state is also demanding access to Rowland’s personal email accounts, to reveal his official bank correspondence.

The judge presiding over the case stressed that the emails are a “potentially important” source of information, though Rowland claims his personal accounts do not contain any relevant information.

“Banque Havilland firmly denies any allegations of improper conduct,” a spokesman for the bank said.

“The bank categorically denies any allegation regarding the hiding of evidence.”

Manipulation of Qatar’s currency

In 2019, Qatar took Banque Havilland to court in London, accusing it of orchestrating an attack that cost the country $40 billion to support its currency and resulted in the liquidation of nearly $3 billion in US Treasury bills and notes that were held in New York, according to the complaint.

The bank defended itself by saying it was simply a “risk-management strategy” for UAE holdings of Qatar’s bonds, created in September 2017, months after Qatar’s Central Bank claimed the manipulation happened.

Qatar used a presentation prepared by a Banque Havilland analyst as evidence and claimed the document detailed an attempt to deplete the country’s reserves and damage its ability to host the 2022 World Cup.

The emergence of direct links between Mohammed bin Zayed, or MBZ as he’s commonly known, and Banque Havilland show that the Abu Dhabi crown prince was one of the biggest customers of the bank through emails documents and legal filings.

Read also: Timeline: How the GCC crisis erupted over three years

The bank has advised MBZ and the UAE sovereign wealth fund, Mudabala Inc. on several matters including the manipulation of Qatar’s currency, business deals in Zimbabwe despite sanctions and helping place the bank’s chairman at the time on the board of Human Rights Watch after it published reports critical of the country.

In 2017, the bank created a presentation to help manipulate Qatar’s currency and bond markets after the illegal blockade of Qatar by Saudi Arabia, the UAE, Bahrain and Egypt was imposed.

The presentation that recommended the UAE “control the yield curve” to “decide the future,” reached MBZ and Yousef Al Otaiba, the UAE’s ambassador to the US, through Will Tricks, a former MI6 officer and now advisor to the crown prince.

Soon after the manipulation plan was sent to Bin Zayed, the Qatari riyal – under pressure since the beginning of the Gulf Crisis in June 2017 – went into free fall and hit a record low.

The yield on Qatar’s 10-year bonds also soared, as did the cost of insuring the country’s debt against default. The currency didn’t recover until November of that year.

The Luxembourg bank maintained that former MI6 agent Will Tricks had not forwarded the plan to anyone, but failed to address how it ended up in the inbox of the UAE ambassador to the US.

“Banque Havilland firmly denies any allegations of wrongdoing or improper conduct made by the State of Qatar,” a spokesman for the bank said in an emailed statement.

“The bank was not part of any conspiracy against Qatar and rejects all of Qatar’s claims.”